Saving for Retirement Through Your Corporation

Saving for Retirement Through Your Corporation: RRSP vs Holdco Strategies for Incorporated Canadians

By Bill Craven, B.A., CFP®, EPC

Mutual Fund Representative |Life Insurance Advisor | Investia Financial Services Inc.

Incorporated in Ontario and thinking about retirement? Your options go far beyond the average Canadian’s. This guide breaks down how using your corporation — or holding company — can unlock new layers of flexibility, control, and long-term value.

If you own a business or work as an incorporated professional, chances are you already approach your finances differently than most Canadians. You manage income with intention, prioritize flexibility, and often look beyond standard advice.

Yet when it comes to retirement, the message still sounds familiar:

“Max out your RRSP — that’s the best strategy.”

But is it?

For professionals whose corporations are building retained earnings — or who have explored the idea of a holding company — there may be additional retirement strategies worth considering. These aren’t secret loopholes, but they also aren’t part of most cookie-cutter plans.

This article explores one of those possibilities:

Could saving through your corporation offer greater long-term flexibility and value than relying solely on your RRSP?

We’ll walk through the logic, outline the trade-offs, and explain how professionals across Ontario — especially in Chatham, London, and Toronto — are approaching retirement differently than ever before.

Note: Setting up a holding company requires legal and tax guidance. While we help clients evaluate the strategy and build retirement plans around their structure, we do not set up corporations or offer tax advice.

Many people ask: “Should I save for retirement inside my corporation or personally?”

For incorporated professionals, this is one of the most common questions we hear. And it’s a good one.

Saving through your corporation can offer more flexibility, deferral advantages, and investment potential — but it’s not a one-size-fits-all solution. The right approach depends on your income, lifestyle, and whether you need that money personally in the short term. In many cases, the best plan combines personal and corporate strategies.

Why Corporations Offer Unique Retirement Advantages

If you’re incorporated, you hold a unique advantage: your business generates earnings that haven’t yet been taxed personally. That opens the door to a different kind of planning — one that most Canadians simply don’t have access to.

Here’s why many business owners and professionals choose to build their retirement savings within the corporation:

1. More Dollars Working for You

Leaving retained earnings in the corporation — instead of taking them all as salary or dividends — means you’re working with more capital. That’s because corporate income in Ontario is often taxed at lower combined rates (approximately 12.2% for small businesses).

Compared to top personal tax rates that can exceed 50%, that difference compounds significantly over time. You start with more money working for you — and that makes a difference.

2. Deferral Power and Payout Control

By saving inside the corporation, you can defer personal taxes until later — ideally, when your income is lower or when a drawdown strategy can minimize tax exposure.

You also control when and how income is distributed. This can be critical when coordinating with government benefits, retirement income layers, or family tax planning.

3. No Annual Contribution Limits

RRSPs have strict annual contribution caps. Your corporation doesn’t.

If you’ve already maxed out your RRSP and TFSA, corporate investing gives you a way to keep saving — without hitting a wall. Whether it’s market-based investments, real estate, or other assets, your retained earnings can keep working.

4. Flexibility Over Time

One of the most valuable aspects of corporate savings is control. You’re not bound to rigid withdrawal rules. You can smooth out income, manage your effective tax rate, and plan more strategically for retirement — not just react to it.

This flexibility is one of the reasons professionals like doctors, consultants, and small business owners often use their corporation or holding company as the foundation of their retirement strategy.

This article shares general concepts only. Every client’s financial strategy is different. For decisions involving your corporation, speak with your tax advisor, lawyer, and financial planner to ensure your plan aligns with your specific structure and long-term goals.

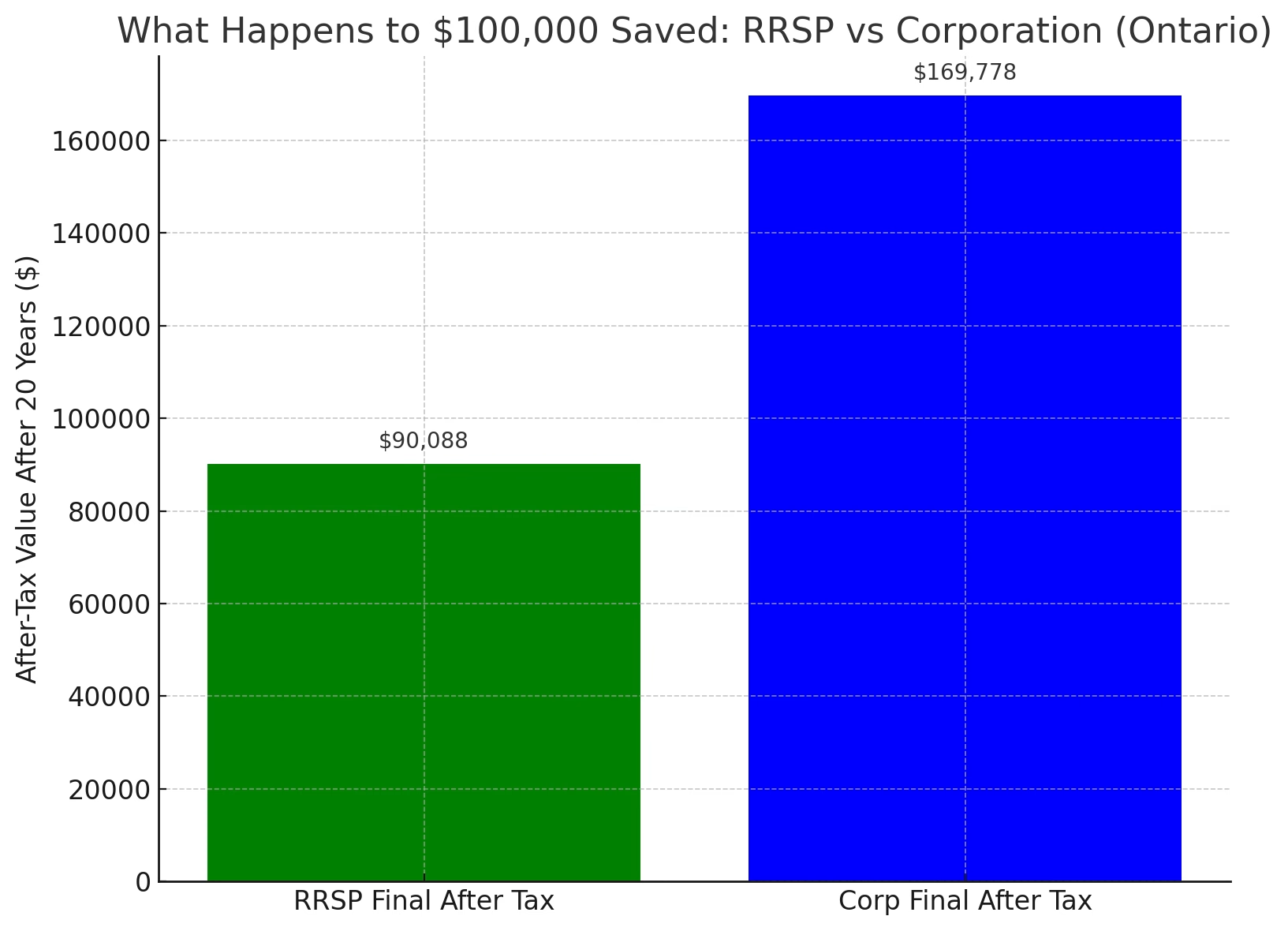

What Happens to $100,000 Saved: RRSP vs Corporation (Ontario)

Comparison of after-tax value after 20 years using Ontario tax rules

This chart illustrates the significant long-term after-tax difference between saving inside a Registered Retirement Savings Plan (RRSP) versus retaining earnings inside a Canadian-Controlled Private Corporation (CCPC) and investing corporately.

Source & Calculation:

Data modeled using financial planning software and Ontario tax tables. For personalized recommendations, always consult a qualified CFP® or tax professional.

- Assumptions:

- $100,000 invested for 20 years at a consistent annual return (e.g., 5%–6%)

- Top marginal tax rates applied on RRSP withdrawals at retirement

- Eligible dividend taxation applied to corporate withdrawals

- Small business tax deferral used during growth phase

- No integration or income-splitting strategies used

- Based on Ontario tax rules circa 2025

- Result:

- RRSP After-Tax Value: $90,088

- Corporation After-Tax Value: $169,778

Key Insight: Corporate investing can result in nearly double the after-tax value over 20 years in some scenarios — but comes with complexity, risk, and planning requirements.

RRSP vs. Corporate Investments: What’s the Best Fit for You?

When Canadians think about retirement, RRSPs are often the first tool that comes to mind. They’re familiar, tax-deferred, and widely recommended. But for incorporated professionals, there’s another powerful option: saving and investing through the corporation or a holding company.

Let’s explore the differences — and why combining both may be your best path forward.

Feature | RRSP | Corporation / Holdco |

Tax Treatment | Contributions reduce personal taxable income; withdrawals are taxed later | No deduction on contributions, but corporate tax rates are lower; personal tax is deferred |

Investment Options | Limited to registered-eligible assets (e.g., mutual funds, ETFs, stocks) | Much broader — including real estate, private assets, or even ownership stakes |

Contribution Limits | Yes — capped annually (e.g., $32,490 for 2025) | No formal limit — invest retained earnings based on your corporate structure |

Creditor Protection | Generally strong, especially with locked-in or spousal RRSPs | Depends on how assets are structured inside the corporation or holdco |

Withdrawals | Fully taxed as personal income | Can be structured more tax-efficiently through dividends, CDA, or estate tools |

Which Is Better?

RRSPs are great for reducing taxable income today and building structured retirement income.

Corporate strategies shine when flexibility, deferral, and higher retained earnings are in play.

Many professionals benefit from using both:

- RRSPs to optimize personal taxes and anchor predictable retirement income.

- Corporate investing to grow wealth beyond contribution caps and build flexibility into the later stages of your plan.

Important Note: This is not tax or legal advice. Decisions involving RRSPs, corporations, or holding companies should be reviewed with a certified financial planner, accountant, or legal advisor.

A Smarter Retirement Strategy for Incorporated Professionals in Ontario

If you’re a physician, lawyer, consultant, or professional with a corporation, your business structure offers more than just operational flexibility — it can also become a cornerstone of your retirement strategy.

But it’s not automatic. Getting the most from your corporation means using the right tools at the right time and coordinating your planning with expert support.

1. Retained Earnings: Your Built-In Retirement Engine

When your professional corporation earns income, you don’t have to take it all out right away. Instead, you can leave some earnings inside the corporation, where they’re taxed at lower corporate rates.

These retained earnings can then be invested and grown, giving you the chance to:

- Build your retirement fund using less-taxed dollars

- Defer personal income taxes until you truly need the funds

- Create long-term flexibility with how and when income is accessed

This is one of the key strategies many professionals in Ontario use to retire with more capital working for them — without overpaying taxes too early.

2. When (and Why) a Holding Company Might Make Sense

As you near retirement or start planning the sale or wind-down of your practice, it may be time to move beyond an operating company and consider a holding company (Holdco) structure.

Why incorporate a Holdco?

- You can move retained earnings out of the active business

- It adds a layer of protection and separates business risk from retirement assets

- It allows for smoother income splitting, estate planning, and capital gains planning

This isn’t a one-size-fits-all solution — and it’s not something Bill Craven or Craven Financial sets up directly. But we’ve helped many professionals explore the option with their legal and tax teams when the timing is right.

3. Retirement Tools Inside a Corporation

A professional corporation offers access to several advanced planning tools that go beyond typical RRSPs:

- IPP (Individual Pension Plan): Tax-sheltered pension solution for higher-income earners

- CDA (Capital Dividend Account): A way to flow certain proceeds out of your corp tax-free

- Estate freezes & income layering: Tools for reducing tax exposure and transferring wealth

- Corporate class funds & asset allocation: For better control over investment income taxation

These tools aren’t right for everyone — but when coordinated well, they create a multi-layered retirement strategy that’s uniquely suited to incorporated professionals.

4. Ontario-Specific Considerations

Planning from within a corporation in Ontario brings some unique details into play:

- OAS clawback thresholds — strategic withdrawals help you avoid benefit reductions

- Passive income limits — managing investments so your Small Business Deduction isn’t reduced

- Creditor & liability protection — especially important if you’re still partially active

Every incorporated professional has a unique mix of income, family needs, and future plans. That’s why customized advice — and a long-term view — makes all the difference.

Disclaimer: Craven Financial Planning does not offer legal or tax services, nor do we create corporate structures. We help clients understand how their professional corporation may support their financial goals — and work alongside your accountant or legal advisor to build a strategy that fits.

Key Considerations That Shape Your Corporate Retirement Strategy

When you use your corporation or holding company to support long-term planning, the benefits can be significant — but so can the risks if you overlook the rules.

Understanding how corporate structure interacts with investment income, business operations, and retirement timing is critical. Here are three factors that can influence outcomes:

1. The Passive Income Threshold and Access to Small Business Rates

Canadian tax rules allow the first $500,000 of active business income to be taxed at a reduced corporate rate — around 12.2% in Ontario. But there’s a limitation built into the system:

If your corporation earns over $50,000 in passive investment income, that lower rate begins to phase out.

- Every dollar over the $50K threshold reduces your small business limit by $5

- Once passive income exceeds $150,000, the small business rate is entirely removed — and general corporate rates apply (about 26.5%)

Why this matters:

Even if you’re not actively drawing investment income, the structure and timing of gains can increase taxes on your core business earnings.

Smart strategies may include:

- Allocating investments to a holding company

- Using corporate class investment products

- Managing the timing of dividends, distributions, or portfolio rebalancing

These moves aren’t about avoiding tax — they’re about aligning your income streams to maintain eligibility and minimize friction.

2. Qualifying for the Capital Gains Exemption (CGE)

Selling a successful business can unlock major retirement value — especially if you qualify for the Lifetime Capital Gains Exemption, which shields over $1 million of gains from personal tax.

But qualification depends on strict conditions:

- 90% or more of your corporation’s assets must be tied to active business activities at the time of sale

- Passive holdings (such as cash, investments, or real estate) can disqualify shares if not structured properly

This is where purification becomes important — a planning process that may require:

- Transferring assets to a Holdco

- Adjusting corporate structure ahead of time

- Reviewing share conditions in collaboration with your accountant and lawyer

Waiting until a sale is imminent often limits your options — proactive planning keeps the door open.

3. Using a Holding Company in Retirement

As your working years wind down, restructuring into a holding company can offer practical and protective benefits:

- You can separate retained earnings from business risk

- It provides more room for tax-efficient investing post-retirement

- It simplifies succession planning and estate transfer strategies

You may also unlock tools for:

- Reducing OAS clawbacks by managing income layers

- Income splitting with a spouse or adult child

- Maintaining asset control without active involvement in the operating business

A Holdco isn’t right for everyone — but for incorporated professionals in Ontario, it’s often a strategic lever that creates more control, clarity, and long-term value.

Disclaimer: Craven Financial Planning does not provide legal or tax advice. The strategies described above are for educational purposes only and must be reviewed in partnership with a qualified accountant or legal advisor before implementation.

All examples are modeled using professional planning software and verified against Ontario-specific guidelines as of 2025. Actual outcomes will vary based on your corporation’s structure, income mix, and investment approach.

When Standard Advice Isn’t Enough

Most financial advice in Canada is built for broad audiences — employees with consistent paycheques, predictable expenses, and a need for basic investment guidance.

But when you’re an incorporated professional, that framework stops fitting.

Banks still recommend RRSPs because they’re easy to explain, and most planners stop the conversation there. The result? Many incorporated Canadians miss out on smarter ways to grow and protect their wealth.

What Gets Overlooked

A corporate structure unlocks options that traditional advice rarely addresses:

- Building long-term assets inside a lower-tax environment

- Coordinating income flow to reduce clawbacks and improve eligibility

- Using planning tools like IPPs or CDAs to support retirement and estate goals

- Structuring assets for both growth and protection

- Aligning personal and corporate withdrawals for long-range efficiency

These tools aren’t about complexity for its own sake. They’re about aligning your planning with how your life — and business — actually work.

Why Standard Planning Comes Up Short

If you follow only conventional strategies — contribute to your RRSP, invest surplus income personally — you may end up:

- Paying higher taxes than necessary over the long term

- Leaving advanced planning tools unused

- Facing unnecessary limitations when you need to draw on your savings later

Your retirement income shouldn’t be rigid. And your legacy shouldn’t depend on a one-size-fits-all formula.

What Strategic Planning Looks Like

Professionals who own corporations deserve a more integrated approach.

This is where advisors like Bill Craven, CFP® step in.

He doesn’t just help calculate next year’s contribution room. He takes a wider view — helping clients:

- Structure investments inside and outside their corporation

- Model multiple retirement timelines using tools like Conquest Planning™

- Build drawdown strategies that protect both income and opportunity

- Prepare for what’s ahead: from transition to succession to legacy

This isn’t about products. It’s about structure. It’s about using what you’ve built — your practice, your business, your corporation — to shape a future that fits.

Craven Financial Planning provides education and advice around corporate structure strategy, in coordination with your accountant and legal advisor. Bill Craven is licensed in Ontario through Investia Financial Services Inc. for mutual funds and carries independent insurance licensing.

How Bill Craven CFP® Helps You Retire Smarter

You’ve built a business. You’ve taken the leap to incorporate. And now, as you think about retirement, your priorities go beyond just “saving enough.”

This isn’t about survival — it’s about making your wealth work harder, last longer, and align with the life you’ve earned. That’s where a certified financial planner with deep experience in corporate retirement planning can make the difference.

That’s where Bill Craven, CFP® comes in.

Scenario-Based Planning with Conquest™

No canned projections. No guesswork.

Bill uses Conquest Planning™, Canada’s premier scenario modeling software, to help you:

- Map personal and corporate withdrawals across multiple timelines

- Stress test early retirement, succession, or lifestyle changes

- Evaluate income flows while keeping tax surprises in check

- See real, personalized results — not just industry averages

This planning isn’t theoretical. It’s built around you.

Trusted by Professionals Across Ontario

From Toronto to Windsor — and especially throughout Chatham–Kent, Sarnia, and London — Bill works with:

- Physicians and dentists building long-term practices

- Engineers and consultants growing corporate portfolios

- Entrepreneurs transitioning to succession or retirement

Clients turn to him because he understands the intersection of life, money, and business structure — and helps bring all the pieces together.

A Multi-Layered Retirement Strategy

Bill’s planning framework blends the tools that incorporated professionals need most:

- RRSP and RRIF drawdown optimization

- Holding company design and investment flow

- IPPs and CDAs where suitable

- Succession and estate readiness

- Tax-aware modeling built on real Ontario rules

The result? A retirement path that’s built with control, clarity, and confidence — tailored to how you’ve built your life and your business.

Schedule a Private Planning Call

Thinking about your next steps? Curious how your corporation fits into retirement?

Book a one-on-one strategy call with Bill Craven, CFP®.

📞 [Book Your Retirement Strategy Call]

No pressure. Just professional clarity from someone who understands the road ahead.

Craven Financial Planning offers planning advice in coordination with your accountant and legal advisor. For legal, tax, or incorporation services, seek support from licensed professionals. Bill Craven is licensed for mutual funds in Ontario through Investia Financial Services Inc., and holds independent insurance licensing.

Frequently Asked Questions (FAQ)

1. Should I save inside my corporation or use an RRSP?

If you’re incorporated, you don’t have to choose just one. RRSPs help reduce personal taxable income, while saving within your corporation allows for tax deferral and wider investment choices. Many professionals blend both — the right mix depends on your current income, future plans, and personal cash flow needs.

2. What is an Individual Pension Plan (IPP), and who should consider it?

An IPP is a corporate-sponsored pension plan for business owners or incorporated professionals. It allows for larger, age-based contributions (especially past age 40) and grows tax-sheltered within your corporation. For high-income earners approaching retirement, it can be a key part of long-term planning.

3. How much passive income can a corporation earn before it affects taxes?

Generally, up to $50,000 in passive investment income can be earned without reducing access to the Small Business Deduction (SBD). Beyond that, business income may be taxed at higher rates. Coordinating with a financial planner (and your accountant) helps ensure your investment growth doesn’t erode tax efficiency.

4. Is a holding company useful when I retire from my professional corporation?

In many cases, yes. A holding company structure can help you separate investments from the operating company, reduce risk exposure, and prepare for succession or estate planning. It also provides greater control over how and when you draw income. It’s a strategy often explored in the later stages of a business owner’s career.

What to Remember About Retirement Planning Inside a Corporation

If you’re incorporated in Ontario, your retirement toolkit is different — and more powerful — than most people realize.

Here’s what to keep in mind:

- Retained earnings can be used to invest and grow wealth inside your corporation, often at much lower tax rates than personal income.

- There are no RRSP-style limits — as long as you have retained earnings, you can keep building.

- Specialized tools like IPPs and CDAs are available to you as a corporate owner.

- Passive income rules and SBD erosion must be planned for carefully.

- A blended plan — using both corporate savings and personal tax-sheltered accounts — is often the most effective approach.

- Conquest Planning™ lets you visualize every step with real-time data, not just generalizations.

When done right, your corporation isn’t just your business structure — it’s the foundation of a retirement strategy that’s tax-efficient, future-ready, and custom-built around your life.

Further Resources

1. CRA: Tax Planning Using Private Corporations

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations.html

This is the official Government of Canada page explaining how corporations are taxed, including retained earnings, small business deduction rules, and related planning topics. Great for authoritative sourcing and citations.

2. Conquest Planning – Smarter Retirement Planning with AI

https://conquestplanning.com/en-ca/

Conquest Planning is the AI-powered financial planning platform used by Bill Craven, CFP. It allows real-time scenario testing, strategy suggestions, and helps advisors build customized plans with clarity.

3. Virtus Group: RRSP vs TFSA – Guide for Canadian Business Owners

https://virtusgroup.ca/virtus-insights/rrsp-vs-tfsa-guide-for-canadian-business-owners/

A helpful article comparing personal investment vehicles with corporate tax strategies. It introduces core trade-offs and investment control differences that professionals need to consider.

4. MNP: Do I Need a Holding Company?

https://www.mnp.ca/en/insights/directory/do-i-need-a-holding-company

This guide from MNP (a top Canadian accounting firm) outlines the benefits and risks of using a holding company — including tax planning, liability protection, and passive income management.

5. Coast Capital: Should You Invest Through Your Corporation?

https://blog.coastcapitalsavings.com/owner-know-invest-corporation/

A concise blog post exploring the pros and cons of using a corporation to invest, including tax deferral and income flexibility considerations for incorporated professionals.

6. MD Financial: Guide to Retiring as an Incorporated Physician

https://invested.mdm.ca/guide-to-retiring-as-an-incorporated-physician

Tailored to medical professionals, this guide shows how physicians can use holding companies, dividends, and corporate savings to create a tax-efficient retirement strategy.

7. BDO Canada: Using Your Corporation for Retirement Planning

https://www.bdo.ca/insights/retirement-using-corporation

A practical breakdown of how to use retained earnings, corporate structures, and advanced tax strategies to plan for retirement inside your corporation.

Mutual funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was prepared by Bill Craven who is an Investment Funds Advisor at Craven Financial Planning a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this presentation comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability.

Moving RRSPs and RRIFs to TFSAs

Tax-Efficient Strategies for Moving RRSPs and RRIFs to TFSAs – Advice from Bill Cravenby Bill Craven BA, CFP, EPCUnderstanding RRSPs, RRIFs, and TFSAs in Ontario Retirement PlanningFor many Ontarians, a Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), and Tax-Free Savings Account (TFSA) are the foundation of a

Incorporating RRSPs into Your Financial Plan

Smart Strategies for Tax-Efficient Retirement by Bill Craven BA, CFP, EPC Why RRSPs Are Essential for Smart Financial Planning Retirement planning is a critical financial decision, and for professionals, business owners, and retirees in Ontario, the Registered Retirement Savings Plan (RRSP) remains one of the most powerful tools for tax-efficient

William (Bill) Craven, BA, CFP, EPC, is a seasoned financial expert with over three decades of experience in helping Canadians plan for the future with confidence. As the founder of Craven Financial Planning, Bill has built a reputation for delivering tailored financial planning and insurance strategies that align with each client’s unique goals, tax considerations, and long-term security.

Based in Chatham, Ontario, Bill is a Certified Financial Planner (CFP), Elder Planning Counsellor (EPC), and a Mutual Fund Representative with Investia Financial Services Inc. He provides trusted guidance on RRSPs, TFSAs, retirement income planning, life and disability insurance, estate bonds, and tax-efficient investment solutions.

Recognized for his integrity, personal service, and depth of knowledge, Bill works with individuals, families, and business owners throughout Southwestern Ontario to build financial confidence through personalized, values-based planning.